There is no “one size fits all” formula when it comes to staffing agency markup rates for services. Different regions and sectors have different expectations of healthy margins for profitability. Market sectors within the staffing industry, whether it’s light industrial, clerical, medical, or executive, have distinct markers for where bill rates should be set to make sure your staffing agency is making a profit.

In staffing there’s a fine line when it comes to marking up bill rates to remain competitive while still getting the return that you need to maintain strong operational margins.

So how do you assess the “correct” bill rate at your staffing agency? In order to determine optimal ranges, let’s first discuss the basics of what is covered in the bill rates you’re quoting.

Obviously, you must pay your employee first. Second, you have a burden rate which includes your statutory expenses such as taxes, insurance and other charges required by law. These burdens include Federal Unemployment Tax (FUTA), State Unemployment Insurance Tax (SUTA), Social Security and Medicare and workers’ compensation insurance.

Given these costs, your markup rate will typically be anywhere between 1.45 and 1.75 for a profitable business depending on the size of the order. From this markup, you can assess your gross margin, which is used to pay overhead expenses and determine bottom-line profit.

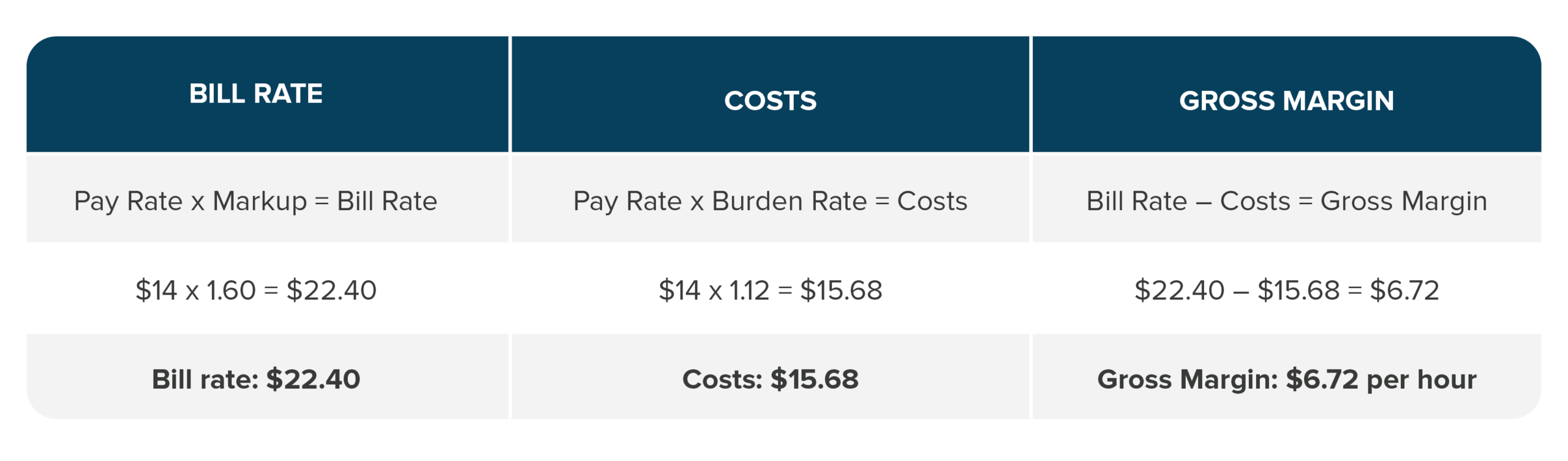

To help you keep track of gross margin and profitability, here is a simplified formula that you can use to assess whether your bill rate is set at an appropriate amount.

Example with a 60% Markup:

- Burden rate (i.e. statutory expenses): 12%

- Typical Pay Rate on Clerical Assignment: $14.00 per hour

- Markup (typically between 45-75%): 60%

Formula:

For a more customizable way to see how different rates impact profit, check out our staffing agency bill rate calculator here

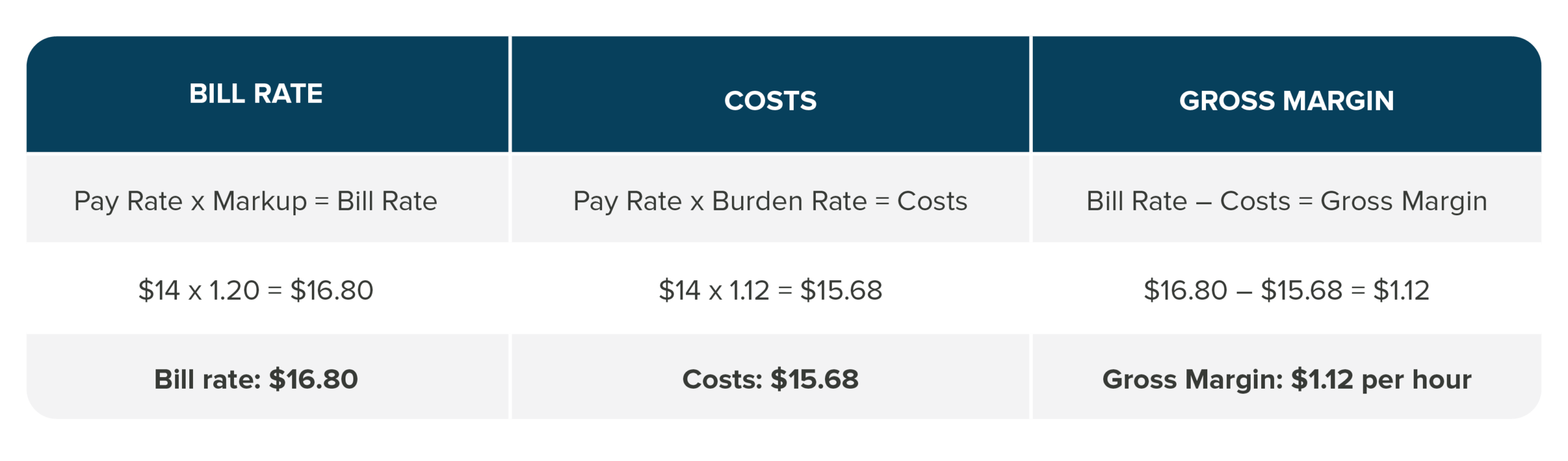

Now let’s take another example so you can see how the markup affects your gross margin. In this example, we will use a 20% markup.

Example with a 20% Markup:

- Burden rate (i.e. statutory expenses): 12%

- Typical Pay Rate on Clerical Assignment: $14.00 per hour

- Markup (typically between 45-75%): 20%

Formula:

Since your costs remain the same, your gross margin depends on making sure that your markup is set at an appropriate amount. This amount can vary significantly based on the size of the order.

For example, your markup may be lower in order to staff a high-volume contract. While there may be a lower margin per worker, you’re able to recoup expenses based on the head count. Otherwise, it is generally advised to stay in the 45-75% range to reach a typical revenue and net profit goal for a staffing agency.

To demonstrate the two examples above, let’s assume this order was for a 12-week contract for three clerical temporary employees at 40 hours per week.

The 60% markup example would equate to a $9,676.80 gross profit. Meanwhile, the 20% markup equates to a $1,612.80 gross profit.

While winning an order from a customer might seem important, it might not be profitable for your staffing agency in the end. Depending on your overhead costs, this formula can be a helpful tool to help you determine where your markup needs to be in order to cover overhead costs, meet your revenue goals and contribute to plans for growth.

To learn more about staffing agency markup rates and tips to ensure profitability, download our guide, Maximizing Margins in Challenging Economic Times, now

If you find yourself with more questions surrounding bill rates and burdens, reach out to the Lone Oak Payroll team today. Our goal is to partner with clients and help them make smart business decisions for their staffing verticals.

Note: The information and examples provided above were used only for demonstration purposes. In no way does this article offer or provide financial advice. Every business is unique and expenses, margins, and other costs may vary. Please contact a licensed accountant or attorney for advice specific to your business.